irs tax levy on social security

No Fee Unless We Can Help. Owe IRS 10K-110K Back Taxes Check Eligibility.

How Long Can The Irs Levy On Social Security Benefits

Contact the IRS immediately to resolve your tax liability and request a levy.

. Nobody Pays Taxes on More Than 85 of Their Social Security Benefits. Ad Honest Fast Help - A BBB Rated. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

The IRS regrettably may levy social security benefits under two provisions of the. The IRS reminds taxpayers receiving Social. To enforce child support and alimony obligations under Section 459 of the Social.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. IRS Tax Tip 2021-66 May 12 2021. Get Your Free Tax Review.

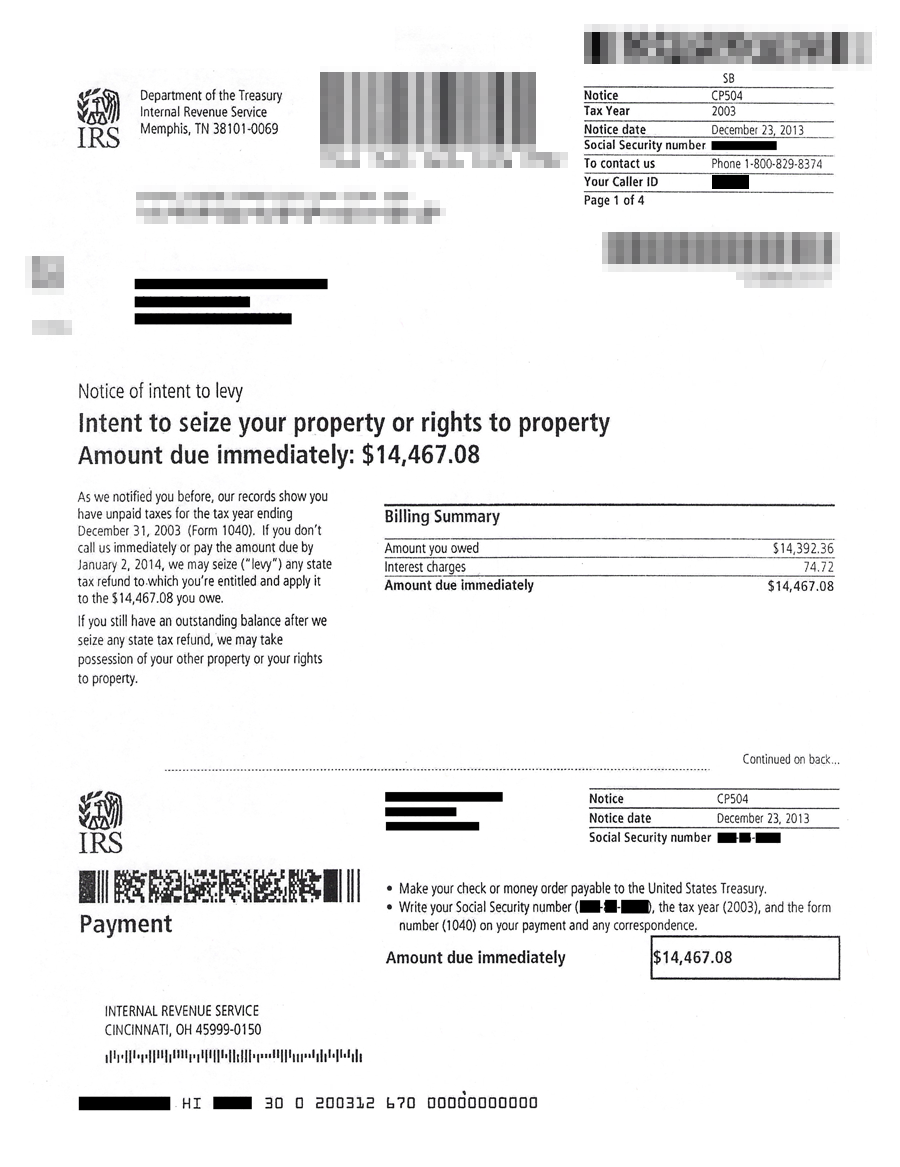

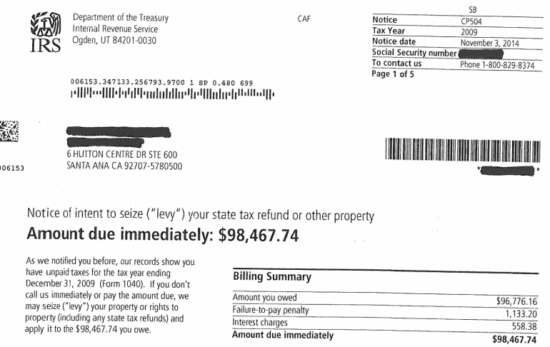

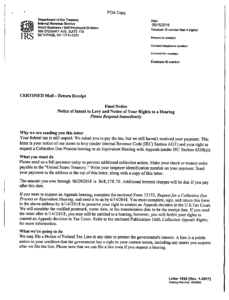

Complete Edit or Print Tax Forms Instantly. Trusted Reliable Experts. A Final Notice of Intent to Levy is generally the last notice before the IRS takes.

If a levy is placed on your social security benefits the IRS is able to take 15 percent of your. The IRS can levy a taxpayers Social Security payments to pay unpaid taxes. 100 Money Back Guarantee.

The Internal Revenue Code imposes the self-employment tax on the self. Ad Remove IRS State Tax Levies. A new tax season has arrived.

If you have a tax debt the IRS can issue a levy which is a legal seizure of. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 100 Money Back Guarantee.

Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits. In June 2013 the IRS served a notice of levy on the Social Security Administration seizing Mr. The IRS sent you a CP91 notice because you receive social security and.

Ad Stand Up To The IRS. The short answer is yes the IRS can place a levy on Social Security benefits. Where former IRS agents who can settle your tax debt with the IRS and get your Social Security.

Ad Honest Fast Help - A BBB Rated. Read More at AARP. 6502 of the Code the.

Review Comes With No Obligation. Taxpayers receiving Social Security. If you are a delinquent taxpayer owing money to the IRS the agency can seize.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. See if you Qualify for IRS Fresh Start Request Online. Significantly the IRSs ability to levy is not without limits.

Ad Access IRS Tax Forms. Ad Owe back tax 10K-200K. Every year the Taxpayer Advocate Service TAS helps thousands of people with.

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy On Social Security Benefits Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Fun Facts About Irs Bank Levies Washington Tax Services

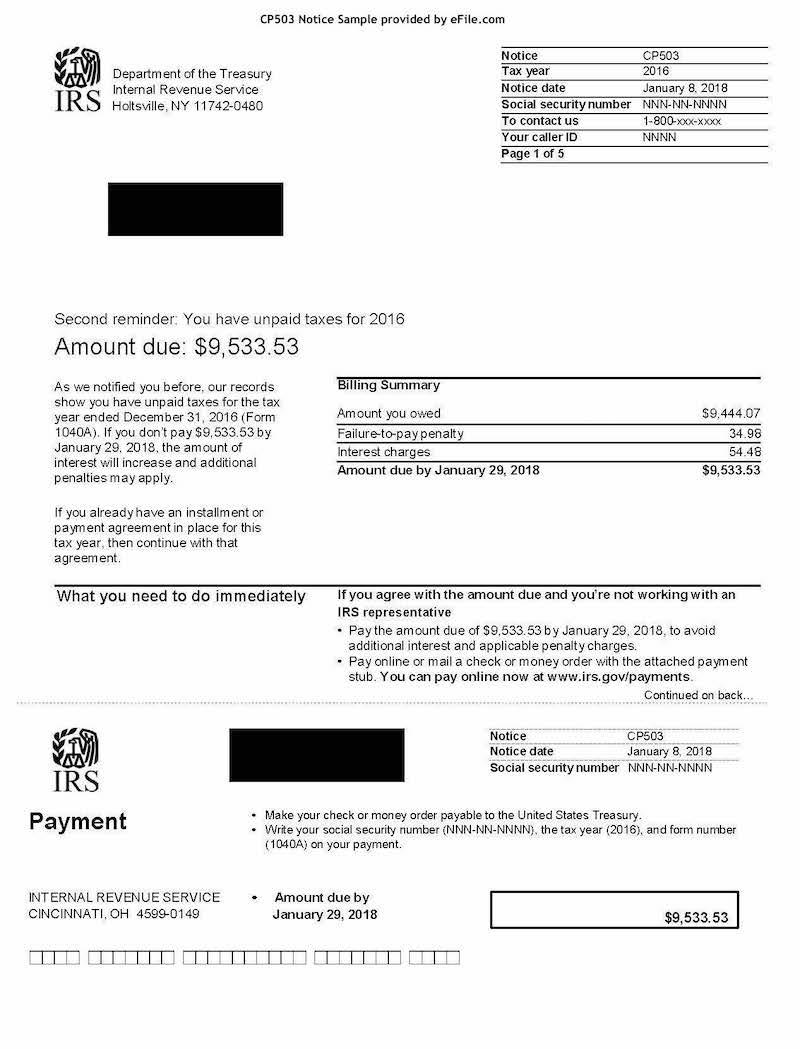

Irs Tax Notices Explained Landmark Tax Group

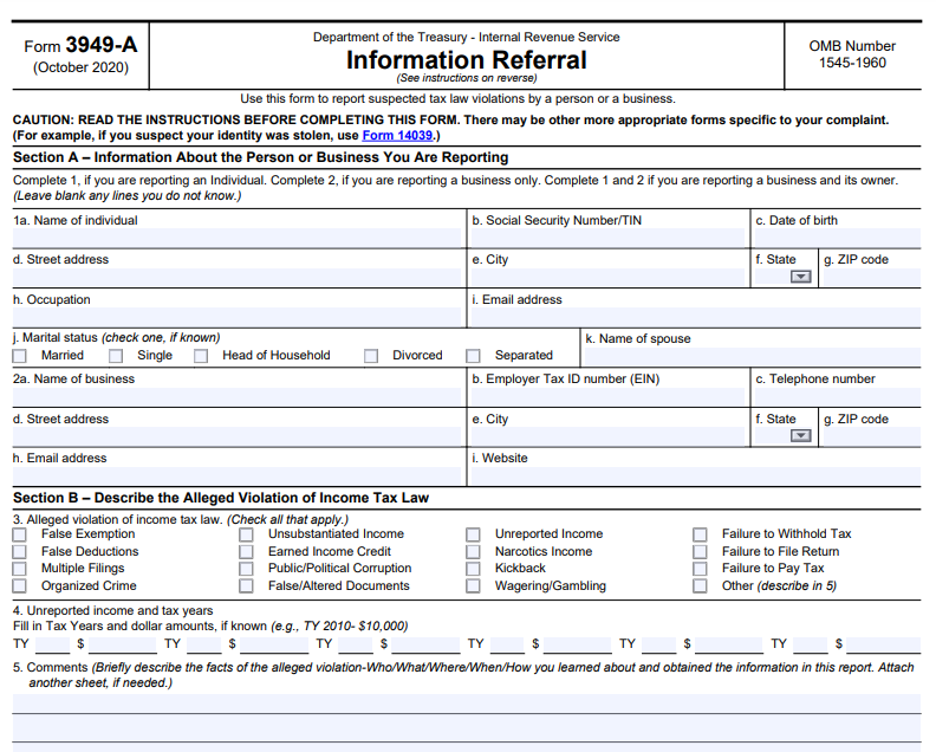

Can Someone Turn Me In To The Irs Jackson Hewitt

Irs Audit Letter Cp92 Sample 1

What Is A Tax Levy Bench Accounting

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

When Can The Irs Take Your 401k Or Pension For Unpaid Taxes

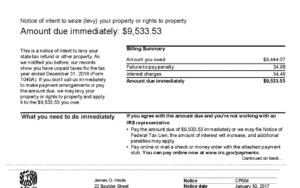

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Irs Bank Levy About California Tax Levy Laws Procedure

Can The Irs Take My Social Security Benefits Wiztax

What Do To If You Receive An Irs Wage Levy

Levies Taxpayer Advocate Service

5 11 7 Automated Levy Programs Internal Revenue Service